6 Ways to Get Help Saving for Retirement

When you are young and working, retirement savings may be put on the back burner out of necessity in order to pay off more immediate bills and debt. If so, you are not alone. A shocking 36% of Americans have yet to begin saving for retirement. In fact, 41% say they don’t even have $500 socked away for emergencies. But without retirement savings or a retirement plan you will not be able to maintain your standard of living when you retire. Although retirement may seem far away and it may seem very difficult to save, saving money now has major benefits.

New Era Debt Solutions explains 6 ways to receive help when saving for your future:

1. Take Advantage of Your Employers 401k Plan

Find out if your employer offers a health savings account, dependent care savings account, or a flexible savings account designed to help with saving for retirement. These benefits will reduce your taxable income and increase your ability to save more money. You will also want to find out if your employer offers a 401(k) match. This means that your employer will invest a certain amount of money into your 401(k) account for every amount that you invest. According to a 2017 analysis by the Federal Reserve, more than three-quarters of full-time jobs offer some kind of retirement savings benefit, and new workers may even be auto-enrolled in one. Make sure to increase your contribution to your retirement savings or at least set up an auto-escalation so that you put in more each year.

2. Get an IRA or a Roth IRA

If your employer does not provide a 401(k) account, consider an Individual Retirement Account (IRA). An IRA is an investment account that has special tax benefits that can help you save for retirement. Anyone with an earned income that is claimed for tax purposes or who has a spouse with earned income can open up and contribute to an IRA. The government can’t give you an unlimited amount of tax breaks, so there are contribution limits on all types of IRAs. The maximum contribution to an IRA in 2023 is $6,500 a year if you’re under 50 years old. If you’re over 50, your contribution limit goes up by $1,000 to $7,500.

For tax year 2024 the limits increase to $7,000 if you’re under 50 years old and $8,000 if you’re 50 years old or older.

Another option is a Roth IRA. Roth IRAs have the same contribution limits as a traditional retirement account. However, the contributions are after-tax dollars. Withdrawals in retirement, including the earnings are tax-free.

The top four IRA and Roth IRA accounts to open in 2019 include:

- Merrill Edge IRA

- Ally Invest IRA

- TD Ameritrade

- E-Trade IRA

3. Consider Taxable Investment Accounts

While maximizing your retirement savings, don’t forget about taxable retirement accounts. If you plan to retire early, there’s a good chance you won’t be able to access a 401(k) or IRA without penalty. A taxable retirement account can provide you with additional options when saving for retirement.

Finally, depending on your situation, a taxable account can aid you in certain investments. For example, it might make more sense to hold municipal bonds in a taxable account than to put them in a traditional IRA or retirement savings account.

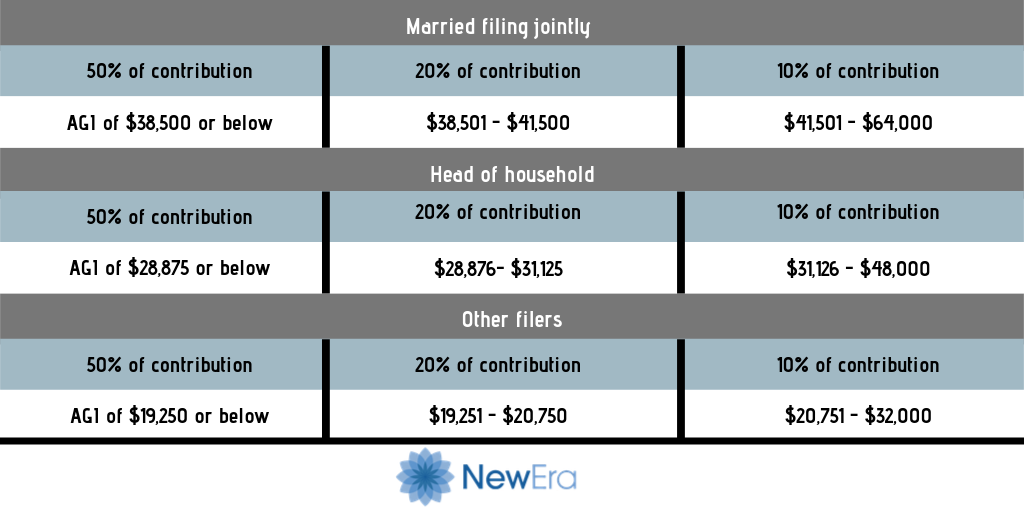

4. Check Out Saver’s Credit

Uncle Sam wants you to save for retirement so much that he offers a tax credit for doing so. The retirement savings contribution credit is available for mid and low-income taxpayers who save for retirement. The Saver’s Credit is worth up to $1000 per person. You are eligible for the Savers Credit if you are 18 or older, not a full-time student, and not claimed as a dependent on someone else’s tax return. You must also make a retirement plan or IRA account contribution and fall under the maximum adjusted gross income caps the IRS sets each year:

Beginning in 2018, the Saver’s Credit can be taken for your contributions to an able account if you’re the designated beneficiary. However, money moved from another able account or from a Qualified Tuition Plan does not qualify for the credit.

5. Home Equity

The equity you have built up in your home can be used to help pay for retirement if you downsize. By moving into a less expensive home or a more affordable county you can make a profit to be used for retirement savings. If you want to stay in your current home, a reverse mortgage can also help you to use some of your home equity for living expenses.

The downside to a reverse mortgage is that the loan balance increases over time. As home equity is used, fewer assets are left to leave to your heirs. You can still leave the home to your heirs, but they will have to repay the loan balance.

6. Social Security

The social security system forces you to save 6.2 percent of your earnings for retirement, and then pays it back to you in your retirement in monthly payments that are adjusted for inflation. You can boost the monthly amount you will receive by delaying when you sign up and coordinating payments with your spouse.

Saving for Retirement FAQs

How Much Savings Do I Need to Retire?

The most common question Americans ask about retirement is how much they need to retire comfortably. While this may be the most pressing question that many Americans have when it comes to saving for retirement, the answer is that the amount needed to retire is different for everyone.

There may not be a retirement savings size that will work for all Americans, but you can estimate how much you may need by calculating costs for factors such as: Housing/property costs, day-to-day living costs such as food & fuel, potential healthcare costs (including budgeting for long-term care), insurance premiums such as those for cars or properties, entertainment & leisure costs.

When Should I Start Saving for Retirement?

Even if you can only save a few dollars a month, now is always the best time to start saving for retirement if you have not already. It may not seem like much of a retirement plan to save a few dollars every month, but given years of time, compound interest can turn a small savings account into a 6 or 7-figure retirement fund.

Achieve Freedom from Debt Before Retiring

New Era Debt Solutions has settled more than $275,000,000 dollars of debt since 1999 and wants you to be our next success story. If you need assistance achieving financial freedom or building a retirement savings plan, contact one of our friendly counselors at New Era Debt Solutions to learn more about finding the debt relief option that best fits your needs and budget. Our team is with you you every step of the way.