What is a Credit Utilization Ratio?

Trying to understand how your credit score is calculated can be a tough task. A variety of sources claim some factors have a greater influence than others, which can add confusion to understanding the best way to utilize your credit cards. New Era Debt Solutions discusses one of these factors and how it can impact your credit score – the credit utilization ratio.

What is the credit utilization ratio?

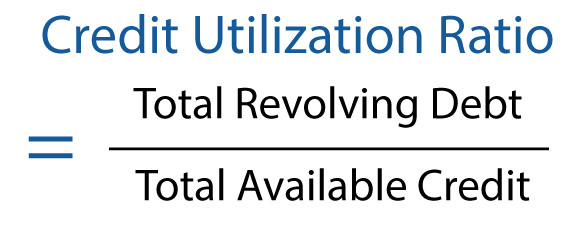

Sometimes referred to as a credit utilization rate or debt utilization ratio, your credit utilization ratio is your balance amount compared to your credit card limit. You can calculate your unique credit utilization ratio by using the debt ratio utilization formula which involves dividing the amount of revolving credit you have by the total credit you have available. Revolving credit is simply credit that is renewed once you pay off the amount owed on your account. It the opposite of installment credit, where you have fixed payments each month.

What is the best credit utilization ratio?

The magic number for credit utilization ratios is 30. Your credit score may receive a boost from using less than 30% of your credit limit. Credit bureau Experian crunches the numbers to explain, “…if your total credit limit is $10,000, your total revolving balance shouldn’t exceed $3,000.” Though you cannot control all the factors that influence your credit score, you should focus on what you can control to improve your score.

How can you maintain a good credit utilization rate?

More often than not, credit score improvements take time. Continue to pay your statements on time and maintain a low credit utilization ratio to start seeing a difference in your score. Your rate constantly changes as your balance and limit fluctuate. The best way to improve your debt utilization rate is to reduce the amount you owe on your accounts and request a credit increase.

It is crucial to remember that with credit increases comes great responsibility. You should strive to spend less than 30% of your limit and remind yourself that you must be careful when using your credit card for larger purchases. High credit limits increase your purchasing power, but that does not mean you should take advantage of that increased spending ability unless there is an emergency.

You can also maintain or improve your credit utilization ratio by keeping credit card accounts open that you do not use. This does not mean you should open several credit cards just to lower your credit utilization rate. Use the credit cards that work best for your financial situation and try not to overload on opening new accounts.

One of the best ways to improve your credit score is by demonstrating that you are a reliable borrower. Ensuring you have a low credit utilization rate can positively impact your score, especially if you are recovering from debt and are looking to improve your credit history.

Get Help with Your Credit Utilization Rate with New Era Debt Solutions

Are you struggling with the harsh realities of debt? Want to improve your credit utilization ratio? New Era Debt Solutions wants to help you get back on the road to financial freedom. Contact one of our friendly counselors today for a free consultation to start living debt free.